Accounting for Professional Service Firms

Cash flow in service businesses is complex. Bloomfield CFO offers clean books and strategic support for firms that bill hourly, by project, or retainer.

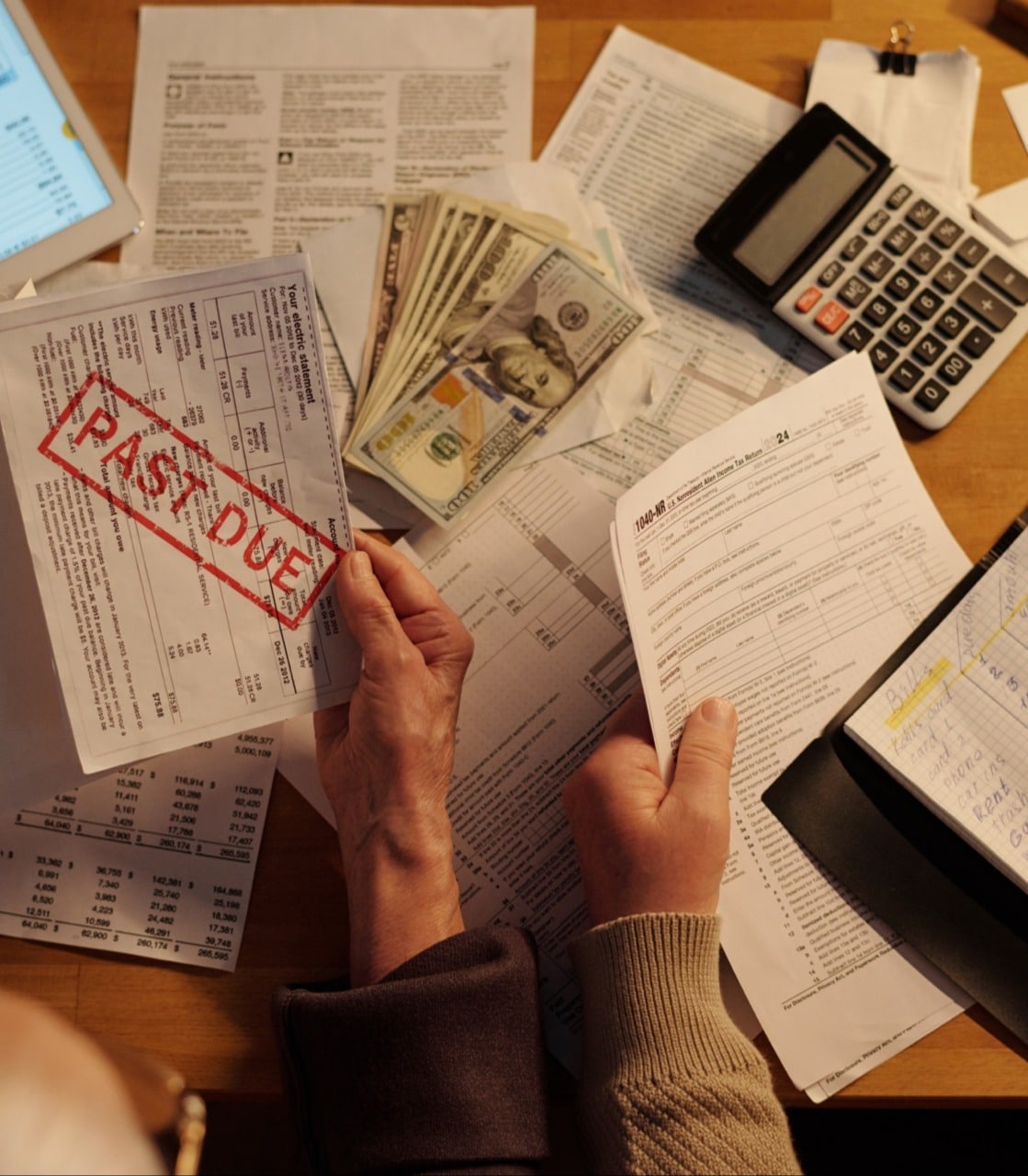

Financial Blind Spots Hold Growing Firms Back

Professional firms often grow quickly—but without the right financial structure, that growth gets messy. Without the right support, you risk:

- Poor visibility into billable vs. non-billable work

- Unreliable reporting for project profitability

- Underpricing due to unknown overhead costs

- Late payroll or cash flow surprises

- No strategy for scaling or succession

Behind Every High-Performing Firm Is a Strategic Finance Partner

Professional firms don’t just need someone to file taxes—they need a partner who understands their business model, keeps the books clean, and helps them make confident decisions as they grow. Here’s how we support firms that want clarity, strategy, and long-term financial strength:

Monthly bookkeeping and reconciliations

Payroll support for salaried, hourly, and contract staff

Cash flow forecasting and owner compensation strategy

Tax planning for partners and pass-through entities

Optimize retainers and fee percentages

Leverage management software for complete and accurate data

“We finally understand what’s driving profitability.”

More Clients, More Staff… More Complicated

We help growing firms structure themselves not just for today—but for the next stage of growth. Whether you’re scaling your team, shifting equity, or preparing for retirement, we provide the financial and strategic insight to help you do it right.

Multi-partner or shareholder ownership

Clarify roles, responsibilities, and equity splits to avoid confusion and ensure financial alignment as your leadership team grows.

Entity structuring for pass-through income and liability protection

Set up the appropriate legal and tax structure from the start—or clean up what’s already in place—to minimize risk and optimize earnings.

Retirement planning for partners and shareholders

Plan ahead for internal buyouts, phased exits, or complete transitions—without disrupting operations or cash flow.

Strategic budgeting for expansion, tech investment, or hiring

Forecast confidently when making major decisions like hiring senior talent, upgrading equipment, or opening a second office.

Tax projections that align with your growth season

Avoid surprise liabilities and stay ahead of quarterly payments with proactive planning that reflects your revenue cycles and margins.

You Deliver Professional Advice. So Do We.

We know the expectations that come with being a trusted advisor—because we hold ourselves to the same standard. Bloomfield CFO supports professional service firms across the U.S., delivering clear reports, proactive strategy, and real human support.

“They helped us stop winging it and start running like a real business.”

Get the Strategic Support You Deserve

Schedule a Call

We’ll learn about your billing model and structure

Build a Financial Plan

We’ll clean up your books and simplify your systems

Ongoing Support

You get clarity, consistency, and confidence every month

Make Decisions Backed by Real Data

Many professional firms aren’t held back by a lack of business—they’re held back by financial systems that can’t keep up. At Bloomfield CFO, we bring structure to your finances, turn reports into action plans, and help you lead with confidence instead of stress.

We help professional firms clean up their financials, make better decisions, and scale with strategy.

Explore Our Other Industries

Dentistry

Healthcare

Real Estate